San Jose, Calif. Cadence Design Systems, Inc. (Nasdaq: CDNS) today announced it has entered into a definitive agreement to acquire the Design & Engineering (D&E) business of Hexagon AB, including MSC Software, a pioneer in engineering simulation and analysis.

The transaction advances Cadence’s Intelligent System Design™ strategy, expanding its System Design & Analysis portfolio and strengthening its position in the fast-growing structural analysis and multiphysics simulation markets. The acquisition follows Cadence’s 2024 purchase of Beta CAE and further extends its presence in the multi-billion-dollar structural analysis segment.

Under the agreement, Cadence will acquire the business for approximately €2.7 billion, with 70% paid in cash and 30% in Cadence common stock issued to Hexagon. The deal is expected to close in the first quarter of 2026, subject to regulatory approvals and customary conditions.

Expanding Multiphysics Capabilities

As the design industry accelerates toward electrical-mechanical hyperconvergence, customers need more advanced multiphysics simulations earlier in the design cycle. Cadence has built a strong foundation across electromagnetics, electrothermal, and CFD, and with Hexagon’s D&E technology — including flagship solvers MSC Nastran and Adams — will now deliver a unified platform spanning structures, motion, fluids, and electromagnetics.

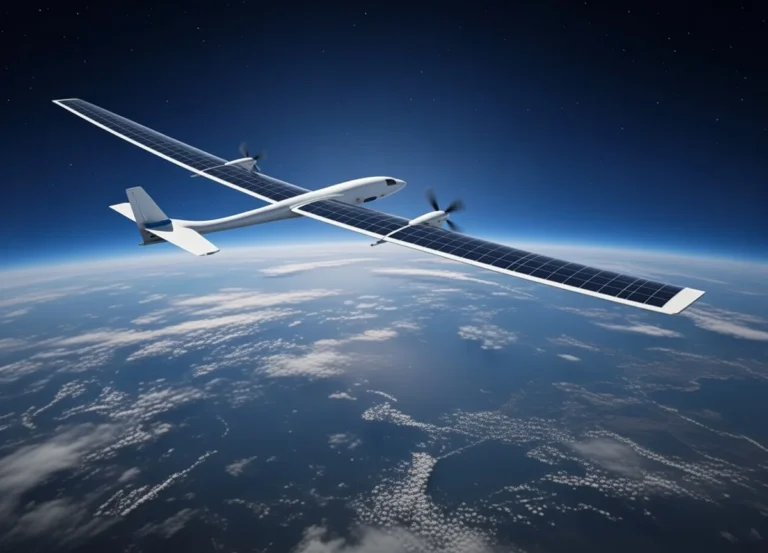

These technologies are widely recognized as industry standards in aerospace, automotive, and robotics, where precise simulation of real-world performance is critical. Adams’ multibody dynamics capabilities also support emerging applications in robotics and physical AI, enabling accurate modeling of motion and interactions.

Industry Impact and Customer Base

The acquisition will enable Cadence to serve an expanded global customer base, including Volkswagen Group, BMW, Toyota, Lockheed Martin, BAE, Boeing, and other leaders in aerospace and automotive who rely on Hexagon’s D&E solutions for mission-critical workflows.

The business generated approximately $280 million in 2024 revenue, supported by 1,100 employees across global R&D, sales, and support teams with deep domain expertise and established ecosystem partnerships.

Executive Perspective

“Cadence has long led innovation in computational software for semiconductors and electronic systems,” said Anirudh Devgan, president and CEO of Cadence. “By adding Hexagon’s world-class simulation capabilities, we will expand Intelligent System Design to capture the full spectrum of physical behavior — from electromagnetics and fluids to structures and motion. This is a pivotal step in enabling our customers to design the converged, complex systems of tomorrow.”

About Cadence

Cadence is a market leader in AI and digital twins, pioneering the application of computational software to accelerate innovation in the engineering design of silicon to systems. Our design solutions, based on Cadence’s Intelligent System Design strategy, are essential for the world’s leading semiconductor and systems companies to build their next-generation products from chips to full electromechanical systems that serve a wide range of markets, including hyperscale computing, mobile communications, automotive, aerospace, industrial, life sciences and robotics. In 2024, Cadence was recognized by the Wall Street Journal as one of the world’s top 100 best-managed companies. Cadence solutions offer limitless opportunities—learn more at www.cadence.com.

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding Cadence’s proposed acquisition of the D&E business from Hexagon, the anticipated timeline and closing of the proposed transaction, talent, technologies, and product offerings, business strategy, plans, and opportunities, industry and market trends including market estimates, and the expected benefits and impact of the proposed transaction on Cadence’s business. Forward-looking statements are based on current expectations, estimates, forecasts, and projections. Words such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “project,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” “shall,” “incoming” and variations of these terms and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are subject to a number of risks, uncertainties, and other factors, many of which are outside Cadence’s control. For example, the markets for D&E technology or Cadence’s products and services may develop more slowly than expected or than they have in the past; operating results and cash flows may fluctuate more than expected; Hexagon or Cadence may fail to satisfy the closing conditions, including obtaining required regulatory approvals, in a timely manner or at all; Cadence may fail to integrate the D&E business; Cadence may fail to realize the anticipated benefits of the proposed acquisition; Cadence may incur unanticipated costs or other liabilities in connection with acquiring or integrating the D&E business; the potential impact of the announcement or consummation of the proposed acquisition on relationships with third parties, including employees, customers, partners, and competitors; Cadence may be unable to motivate and retain key personnel; changes in or failure to comply with legislation, government regulations or other legal requirements could affect the closing of the proposed transaction or post-closing operations and results of operations; and macroeconomic and geopolitical conditions could deteriorate. Further information on potential factors that could affect Cadence’s ability to successfully acquire and integrate the D&E business or otherwise realize the anticipated benefits of the proposed acquisition is included in Cadence’s most recent annual report on Form 10-K, its subsequent quarterly reports on Form 10-Q and its other filings with the Securities and Exchange Commission. The forward-looking statements included in this press release represent Cadence’s views as of the date of this press release, and Cadence disclaims any obligation to update any of them publicly in light of new information or future events.