The Global Drones Market 2026–2036: From Emerging Technology to Core Industrial Infrastructure

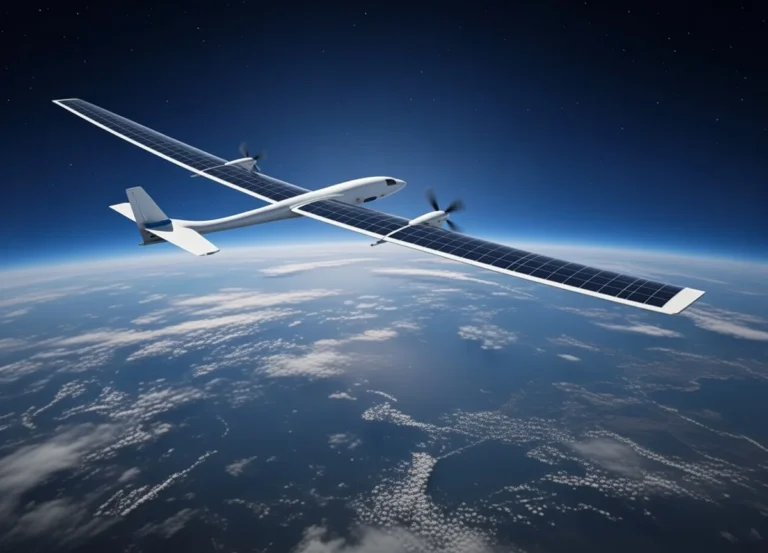

The global drones market is entering a decisive decade of transformation. Once confined largely to military reconnaissance and recreational use, unmanned aerial systems (UAS) are rapidly evolving into a foundational technology that underpins industrial productivity, logistics efficiency, infrastructure management, and data-driven decision-making across a wide range of economic sectors. By 2036, the global drone market is forecast to surpass US$90 billion, driven primarily by accelerating commercial adoption, regulatory maturation, and advances in autonomy, artificial intelligence, and sensor technologies.

What distinguishes the current phase of market evolution from earlier periods is not merely growth in unit volumes, but a fundamental shift in how drones are perceived and deployed. Increasingly, drones are no longer experimental tools or pilot-project technologies; they are becoming embedded components of enterprise workflows, public-sector operations, and national infrastructure strategies. As regulatory authorities expand approvals for beyond visual line of sight (BVLOS) operations and as companies demonstrate sustainable unit economics in areas such as inspection, surveying, and delivery, drones are transitioning from optional innovations to mission-critical assets.

Market Structure and Ecosystem Overview

The global drone ecosystem is typically segmented into three tightly interconnected layers: hardware, software, and services. Each plays a distinct role in the value chain, yet growth across the ecosystem is increasingly interdependent.

Drone services—including aerial data capture, analytics, inspection, monitoring, and delivery operations—currently represent the largest share of market revenue. This dominance reflects the value placed not on the drone itself, but on the actionable intelligence and operational efficiencies that drone-enabled services deliver. Enterprises across energy, construction, agriculture, and logistics increasingly outsource drone operations to specialized service providers rather than maintaining large in-house fleets, particularly in markets with complex regulatory requirements.

However, while services account for the largest share of revenue today, hardware is projected to be the fastest-growing segment through 2036. This growth is driven by multiple converging factors: continuous innovation in airframe design, propulsion systems, battery energy density, and sensor payloads; declining unit costs due to manufacturing scale; and the need for fleet expansion as commercial deployments move from limited trials to full operational rollouts. As enterprises scale their drone programs, demand for higher-performance platforms capable of longer endurance, heavier payloads, and autonomous operation is increasing sharply.

Software forms the connective tissue of the ecosystem, enabling flight planning, fleet management, data processing, and analytics. The integration of artificial intelligence, machine learning, and cloud-based platforms is transforming raw aerial data into real-time insights, predictive maintenance outputs, and automated decision-support tools. Over time, software differentiation—particularly around autonomy, data fusion, and integration with enterprise systems—is expected to become a key competitive battleground.

Technological Convergence and the Rise of Autonomous Operations

At the heart of the drone market’s long-term growth trajectory lies the convergence of several critical technologies. Advances in artificial intelligence, computer vision, sensor fusion, and autonomous navigation are enabling drones to operate with increasing levels of independence from human pilots. These developments are particularly significant for enabling BVLOS operations, which are widely viewed as the single most important unlock for large-scale commercial deployment.

Detect-and-avoid (DAA) systems, real-time obstacle recognition, and onboard decision-making capabilities are reducing reliance on manual control and visual observation. In parallel, unmanned traffic management (UTM) frameworks are being developed to coordinate drone activity in increasingly congested airspace, integrating drones safely alongside crewed aircraft. As these systems mature and gain regulatory acceptance, they will enable entirely new categories of applications—particularly in logistics, infrastructure inspection, and persistent monitoring.

Battery technology and propulsion efficiency remain key constraints, but incremental improvements in energy density, hybrid power systems, and lightweight materials are steadily extending flight times and payload capabilities. Together, these technological advances are reshaping what drones can do, where they can operate, and how economically they can be deployed.

Industry Verticals: Adoption Leaders and High-Growth Segments

The energy sector has emerged as the most significant vertical for commercial drone adoption. Utilities and energy companies deploy drones extensively for powerline inspection, wind turbine monitoring, oil and gas pipeline surveillance, and solar photovoltaic plant assessment. These use cases offer a compelling value proposition: drones dramatically reduce inspection costs compared to helicopters or manual ground surveys, improve worker safety by minimizing exposure to hazardous environments, and generate higher-quality, more frequent data.

In regulated industries where asset integrity and compliance are critical, drones enable more proactive maintenance strategies and faster fault detection. As energy infrastructure ages and as renewable energy capacity expands globally, drone-based inspection is expected to remain a cornerstone of commercial demand.

Logistics, Cargo, and Intralogistics: The Fastest-Growing Segment

While energy leads in absolute deployment, the highest growth rates are expected in cargo delivery, courier services, intralogistics, and warehousing. Companies such as Zipline, Wing, and Manna have demonstrated commercially viable models for last-mile and middle-mile delivery, particularly in healthcare, e-commerce, and food delivery.

The scalability of these applications depends heavily on regulatory progress around BVLOS operations, airspace integration, and automated fleet management. As these barriers continue to fall, drone delivery is likely to expand beyond niche or rural use cases into broader urban and suburban markets, fundamentally altering logistics networks and fulfillment models.

Construction, Mining, and Agriculture

Construction and mining industries rely heavily on drones for mapping, volumetric analysis, progress monitoring, and safety inspections. In agriculture, drones support crop health monitoring, precision spraying, and yield optimization. These sectors benefit from the ability to rapidly collect high-resolution spatial data and integrate it into digital workflows, supporting efficiency gains and improved resource management.

Application Landscape: Mapping, Inspection, and Visual Media

Mapping and surveying remain the most widely adopted drone application category, forming the backbone of use cases across construction, mining, agriculture, and infrastructure development. The integration of high-resolution optical cameras, LiDAR systems, and advanced photogrammetry software enables rapid creation of accurate topographical maps, digital elevation models, and three-dimensional reconstructions at a fraction of the cost and time of traditional methods.

Inspection represents the second-largest application category. Industrial facilities, utilities, transportation networks, and telecommunications operators increasingly rely on drone-based inspection to monitor assets such as bridges, towers, railways, and pipelines. The ability to conduct frequent, non-intrusive inspections improves asset reliability while reducing downtime and safety risks.

Photography and filming continue to generate strong demand, driven by media, entertainment, real estate, tourism, and marketing applications. While this segment is more mature and competitive, it remains an important contributor to overall market volume and innovation, particularly in camera and stabilization technologies.

Regional Dynamics and Geographic Outlook

Asia-Pacific dominates the global commercial drone market, underpinned by China’s unparalleled manufacturing scale and supply chain integration. China accounts for an estimated 70–80% of global commercial drone production, with DJI maintaining a commanding market share across consumer and professional segments. The country’s domestic market scale, coupled with vertically integrated manufacturing, enables rapid innovation and cost competitiveness.

Japan represents another key market, distinguished by a progressive regulatory environment and strong enterprise adoption, particularly in agriculture and infrastructure inspection.

Middle East and Africa: Fastest Growth Trajectory

The Middle East and Africa region is projected to achieve the fastest growth rate through 2036. Infrastructure investment, oil and gas sector requirements, and proactive regulatory frameworks—particularly in the United Arab Emirates—are driving rapid adoption. Governments in the region increasingly view drones as strategic tools for smart cities, security, and economic diversification.

North America and Europe: Scale with Regulatory Complexity

North America and Europe remain substantial markets with strong enterprise demand and technological innovation. However, regulatory complexity—especially around BVLOS approvals and airspace integration—has constrained growth relative to regions with more permissive or centralized regulatory approaches. Continued harmonization and regulatory modernization will be critical to unlocking the full market potential in these regions.

Regulatory Evolution and Market Unlocks

Regulation remains both a constraint and a catalyst for the drone market. Advances in regulatory frameworks—such as FAA Part 107 and emerging Part 108 rules in the United States, EASA’s U-Space framework in Europe, and evolving standards in Asia—are gradually enabling more complex operations. As regulators gain confidence in safety technologies and operational track records, approvals for autonomous and BVLOS missions are expanding.

Over the long term, regulatory alignment and standardization across regions will play a decisive role in shaping competitive dynamics and investment flows.

A Transformative Decade Ahead

The global drones market is poised for sustained, structural growth through 2036. As autonomous capabilities mature, UTM systems are deployed, and regulatory barriers continue to fall, drones will unlock applications that remain constrained today. What was once a niche technology is becoming essential infrastructure—embedded in industrial operations, logistics networks, and digital transformation strategies worldwide.

This transition marks not merely the growth of a market, but the emergence of drones as a critical layer in the global data and mobility ecosystem.

Source Link:https://www.businesswire.com/