Company shares quarterly performance highlights, outlining revenue trends, strategic priorities, and outlook for the remainder of fiscal 2026.

Lumentum Holdings Inc., a global leader in optical and photonic solutions for cloud networking, telecommunications, and advanced industrial applications, has reported strong financial results for its fiscal second quarter ended December 27, 2025. The company delivered significant revenue growth, expanded profitability, and improved operating margins, driven by accelerating demand for optical technologies that support artificial intelligence (AI) infrastructure and next-generation data center connectivity.

President and Chief Executive Officer Michael Hurlston described the quarter as a standout period for Lumentum, highlighting both operational execution and market momentum. According to Hurlston, revenue reached the upper end of the company’s guidance range, while earnings and profitability exceeded expectations by a wide margin. He emphasized that the company’s business model continues to demonstrate strong leverage, allowing revenue growth to translate into meaningful margin expansion.

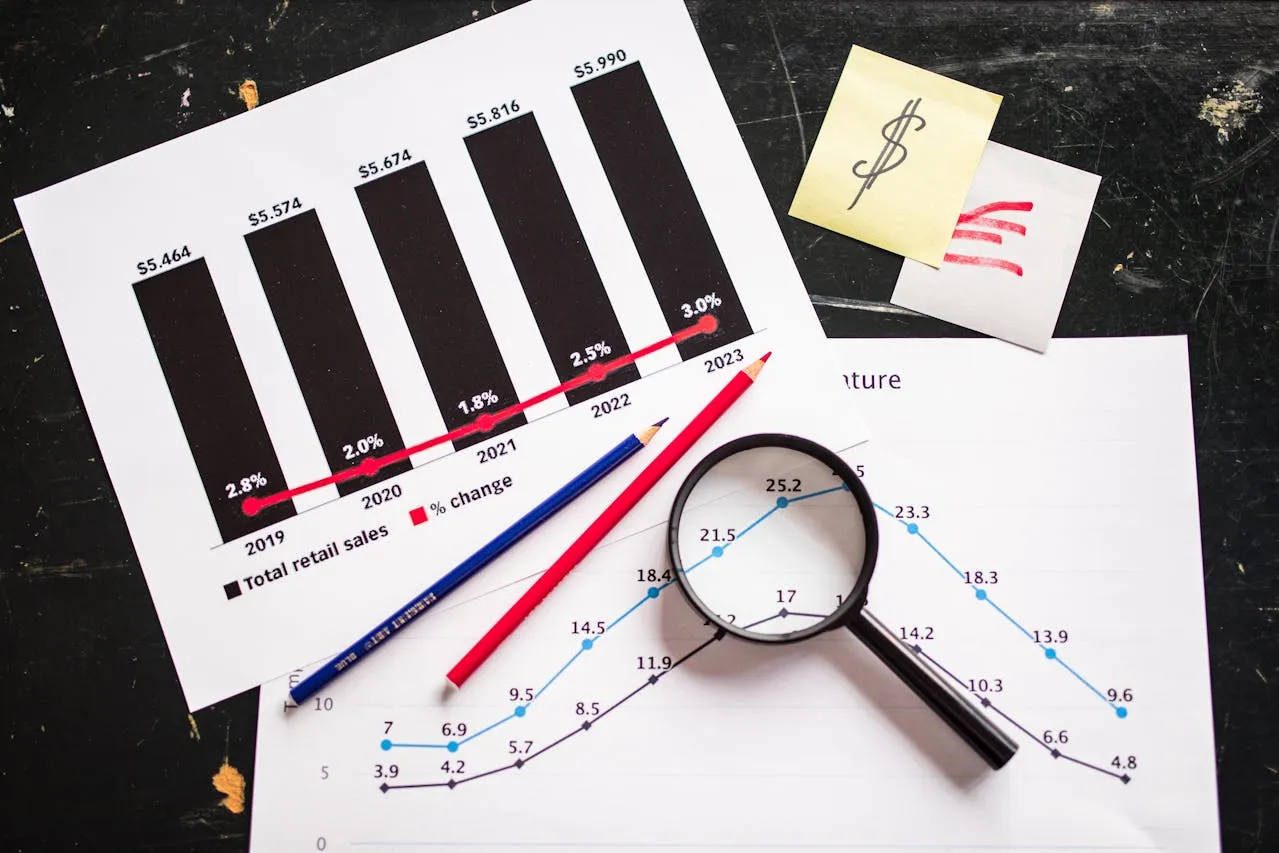

During the second quarter of fiscal year 2026, Lumentum generated net revenue of $665.5 million, representing a 24.7 percent increase compared to the previous quarter and a 65.5 percent increase year over year. This growth reflects rising global investment in AI-driven infrastructure, which requires advanced optical networking components and systems to manage massive data traffic and high-speed connectivity. The company’s strong performance underscores its strategic position within the rapidly expanding photonics market.

On a GAAP basis, Lumentum reported net income of $78.2 million, or $0.89 per diluted share, a significant improvement compared with net income of $4.2 million, or $0.05 per diluted share, in the first quarter of fiscal 2026. In the same period of the previous fiscal year, the company recorded a GAAP net loss of $60.9 million, or $0.88 per diluted share. The turnaround highlights the effectiveness of Lumentum’s operational initiatives and the growing demand for its products across key markets.

Non-GAAP financial performance also showed strong improvement. The company reported non-GAAP net income of $143.9 million, or $1.67 per diluted share, compared with $86.4 million, or $1.10 per diluted share, in the prior quarter and $30.0 million, or $0.42 per diluted share, in the year-ago period. The growth in non-GAAP earnings reflects increased operational efficiency and favorable product mix, particularly in high-performance optical components used in AI and cloud environments.

Gross margin expansion was another highlight of the quarter. GAAP gross margin reached 36.1 percent, an increase from 34.0 percent in the first quarter and 24.8 percent in the second quarter of fiscal 2025. On a non-GAAP basis, gross margin improved to 42.5 percent, compared to 39.4 percent sequentially and 32.3 percent year over year. The improvement demonstrates the company’s ability to scale production efficiently while delivering higher-value products that support advanced networking technologies.

Operating margin performance also strengthened considerably. GAAP operating margin rose to 9.7 percent, up from 1.3 percent in the previous quarter and a negative 12.8 percent in the same quarter last year. Non-GAAP operating margin reached 25.2 percent, reflecting significant expansion compared with 18.7 percent in the first quarter and 7.9 percent in the second quarter of fiscal 2025. The improvement in margins highlights the impact of increased revenue, disciplined cost management, and a strong demand environment for optical solutions.

Breaking down revenue by product category, Lumentum reported $443.7 million in net revenue from components, representing approximately 66.7 percent of total revenue. This segment grew 17 percent sequentially and 68.3 percent year over year, driven by rising adoption of optical technologies for high-speed data transmission. The systems segment generated $221.8 million in revenue, accounting for 33.3 percent of total revenue and delivering sequential growth of 43.5 percent and year-over-year growth of 60.1 percent. The balanced performance across components and systems reflects the company’s diversified portfolio and its ability to serve multiple markets within the optical ecosystem.

Hurlston also highlighted two emerging opportunities that are expected to drive future growth: optical circuit switching (OCS) and co-packaged optics (CPO). The company is scaling its OCS business to meet strong customer demand, which has resulted in a backlog exceeding $400 million. Optical circuit switching technology is gaining traction among hyperscale data center operators seeking more efficient ways to manage high-bandwidth workloads associated with AI applications. Meanwhile, Lumentum recently secured a multi-hundred-million-dollar order related to CPO technology, with delivery expected in the first half of calendar year 2027. These developments indicate strong confidence from major industry players in the company’s technology roadmap.

From a financial position standpoint, Lumentum ended the second quarter of fiscal 2026 with total cash, cash equivalents, and short-term investments of $1.155 billion, an increase of $33.5 million from the previous quarter. The company’s solid liquidity position provides flexibility to invest in research and development, expand manufacturing capacity, and pursue strategic growth initiatives as market demand continues to evolve.

Looking ahead, Lumentum provided guidance for the third quarter of fiscal year 2026, forecasting net revenue in the range of $780 million to $830 million. The company expects non-GAAP operating margins to fall between 30.0 percent and 31.0 percent, with non-GAAP diluted earnings per share projected between $2.15 and $2.35. Management noted that reconciliations between GAAP and non-GAAP measures for the outlook were not provided due to the inherent uncertainty of certain adjustments, including stock-based compensation, acquisition-related expenses, restructuring costs, and other items that may vary significantly.

The company emphasized that its continued growth is closely tied to the expansion of AI infrastructure and the increasing need for advanced optical networking solutions. As data centers evolve to handle more complex workloads, technologies such as co-packaged optics and optical circuit switching are expected to play a central role in improving efficiency, reducing power consumption, and enabling higher data transmission speeds.

To provide additional context on the results, Lumentum scheduled a conference call on February 3, 2026, where executives discussed financial performance, market trends, and strategic priorities with investors and analysts. A live webcast and replay of the call are available through the company’s investor relations website, which also hosts supporting materials and earnings presentations. The company noted that its investor relations platform serves as a primary channel for disclosing material information in compliance with regulatory requirements.

Overall, Lumentum’s fiscal second-quarter results demonstrate strong execution and highlight the company’s growing role in the global AI and optical networking landscape. The combination of robust revenue growth, expanding margins, and promising new technology opportunities positions the company for continued momentum in the coming quarters. As hyperscale cloud providers and enterprise organizations accelerate investments in next-generation connectivity, Lumentum’s optical components and systems are increasingly becoming mission-critical elements of modern digital infrastructure.

With a clear focus on innovation, operational discipline, and strategic partnerships, Lumentum aims to capitalize on the rising demand for high-speed networking technologies while delivering sustainable long-term value for customers and shareholders. The company’s performance during the second quarter reflects not only strong market conditions but also the effectiveness of its long-term strategy to lead in advanced photonics and AI-enabled connectivity solutions.

Source link: https://www.businesswire.com